During the week ended on September 13, 2024, the benchmark

index of Pakistan Stock Exchange experienced volatility early in the week but

gained momentum as investors anticipated a rate cut.

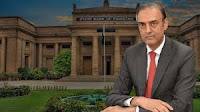

On Thursday, the Monetary Policy Committee (MPC) surprised

with a 200bps reduction amid a higher than expected fall in inflation, lowering

the policy rate to 17.5%. This move boosted investor sentiment.

The IMF spokesperson revealed that Pakistan has secured

necessary financing assurances from development partners and will be discussed

at the executive board meeting scheduled for September 25, 2024, further

enhancing investor confidence. The rate cut invigorated the cyclical sector,

resulting in the benchmark index closing at 79,333 points, a gain of 435 points,

up 0.55%WoW.

However, a mini budget is on the cards to generate an

additional PKR650 billion in tax collections, if FBR fails to meet its

collection targets.

Workers remittance for August 2024 were reported at US$2.94 billion,

up 40.5%YoY.

The average daily traded volume declined to 606.74 million

share from 675.46 million shares a week ago, down 10.2%WoW.

On the currency front, PKR largely remained stable against

the greenback throughout the week, closing the week at PKR278.14/US$.

Other major news flows during the week included: 1) FBR

considering traders’ new proposal to collect advance tax, 2) Pakistan and

Russia sign MoU for agricultural cooperation, 3) Petrol price likely to be

slashed further by PKR12, 4) Privatization of PIA anticipated by end of October

and 5) T-Bills outflows jump amid uncertainty.

Leather & Tanneries, Woollen, Tobacco, Pharmaceuticals

and Property were amongst the top performing sectors, while the laggards

included Leasing companies, Modarabas, Automobile parts & Accessories, Refinery

& Real Estate Investment Trust.

Major net selling was recorded by Foreigners with a net sell

of US$7.54 million. Individuals, mutual funds, and companies absorbed most of

the selling with a net buy of US$16.38 million, respectively.

Top performing scrips of the week were: 1) SRVI, EFUG, PAKT,

BNWN, and HCAR, while to laggards included MTL, PGLC, KOHC, IGIHL, and THALL.

IMF executive board approval, along with continuation of

monetary easing, would keep equities in investor radar, currently trading at

P/E of 3.6x and DY of 13.5%.

Aforementioned factors, along with an improving external

account position and a better country credit rating, would keep foreigners’

interest alive.

AKD Securities recommends sectors that benefit from monetary

easing and structural reforms. However, modest economic recovery may limit the

upside for cyclicals.